Fed: Letting inflation run too hot could lead to 'a significant economic downturn'

Federal Reserve officials worry that letting the U.S. economy run too strong could cause major problems down the road if left unchecked, according to minutes from the most recent central bank meeting. Some members expressed "concern that a prolonged period in which the economy operated beyond potential could give rise to heightened inflationary pressures or to financial imbalances that could lead eventually to a significant economic downturn," the meeting summary released Thursday stated. As a result, almost all officials at the central bank believe they should continue to raise interest rates on a regular basis. That comes even amid substantial worry that current tensions between the U.S. and its trading partners could stall the growth the economy has seen this year. The funds rate moved to a range of 1.75 percent to 2 percent, the seventh such increase since December 2015.

A fourth Fed hike this year could trigger economic slowdown, strategist warns

As it stated in While many may welcome the more hawkish stance from the Federal Reserve after a decade of record-low interest rates, one economist warned that it may actually lead to an economic slowdown. The Federal Reserve hiked rates for the second time this year Wednesday and is looking at two more for 2018 amid observations of a strong outlook for the U.S. economy. But Jim McCaughan, the chief executive of Principal Global Investors, said there are risks involved. "So when we get to a reported level of 2 percent for inflation, the usual central bank target, the inflation rate in reality will be only around 1 percent," McCaughan argued. Wednesday's move by the Fed pushed the funds rate target to 1.75 percent to 2 percent.Trump trade threats could boost China's global economic clout

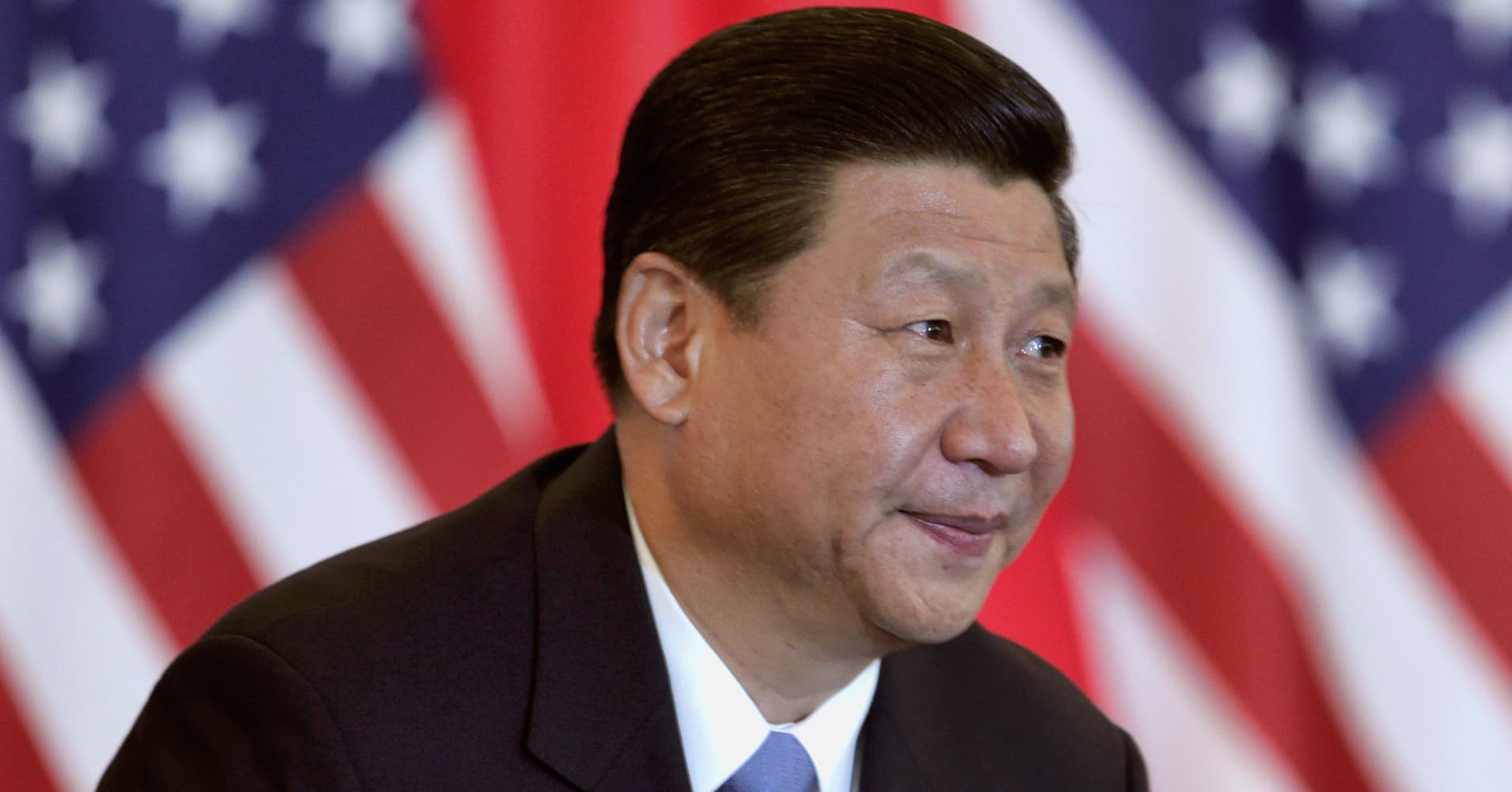

As the United States increasingly confronts China over trade and turns away from decades of championing lower tariffs, Beijing is seen getting a boost from its globe-spanning — and heavily marketed — investment program. China's Belt and Road Initiative is a massive infrastructure project that covers more than 80 countries, claims to seek the revival of historic Silk Road trade routes. Nomura estimates it could be worth at least $1.5 trillion in investments over the next 10 years. China would "be a lot less dependent on the United States" if trade increases with the Belt and Road, he said. Fred Neumann, co-head of Asian economics research at HSBC in Hong Kong, also said the Belt and Road Initiative can benefit China amid the trade standoff with the U.S.

collected by :Donald Luther