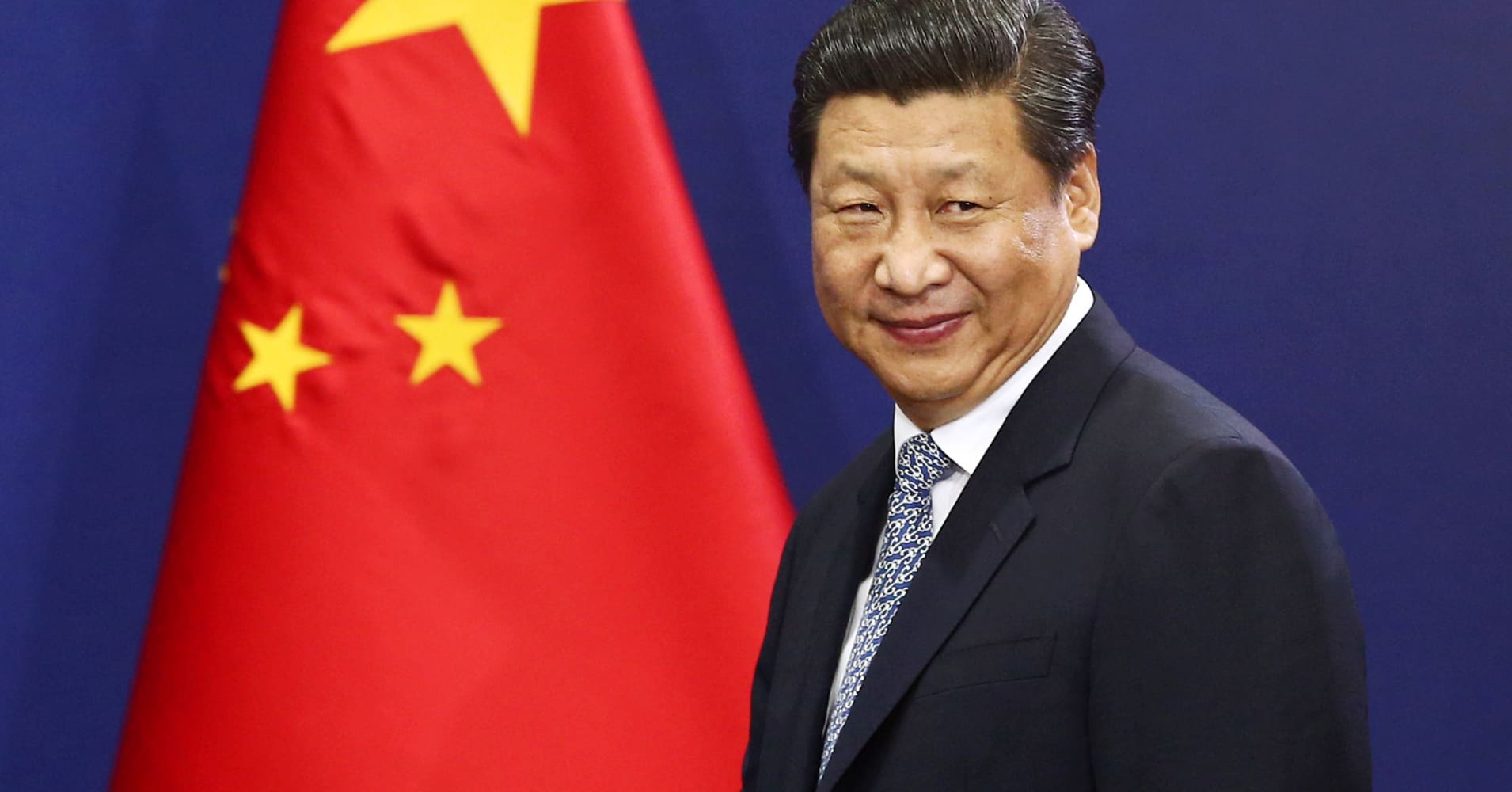

Goldman says U.S. may base tariff decisions on whether China's currency keeps falling

"I don't think they're using it as a lever. "The market just took the dollar/yuan higher...I don't think they're weaponizing it, and it's very dangerous for them to do that. Interest rates rates are going down." And the Americans are saying: 'They used to do it and now they're not, so they're causing it to fall.' "I don't' really see what it is, what rabbit China china can pull out of its hat without looking like pushovers.

Iran currency extends record fall as U.S. sanctions loom

according to DUBAI (Reuters) - Iran's currency hit a new record low on Sunday, dropping past 100,000 rials to the U.S. dollar as Iranians brace for Aug. 7 when Washington is due to reimpose a first lot of economic sanctions. Washington decided to reimpose sanctions upon its withdrawal, accusing it of posing a security threat. On Aug. 7, Washington will reimpose sanctions on Iran's purchase of U.S. dollars, its trade in gold and precious metals and its dealings with metals, coal and industrial-related software. Sanctions also will be reapplied to U.S. imports of Iranian carpets and foodstuffs and on certain related financial transactions. ADVERTISEMENTIran's oil exports could fall by as much as two-thirds by this year due to sanctions, straining oil markets amid supply outages elsewhere.collected by :Mathio Rix